Highlights:

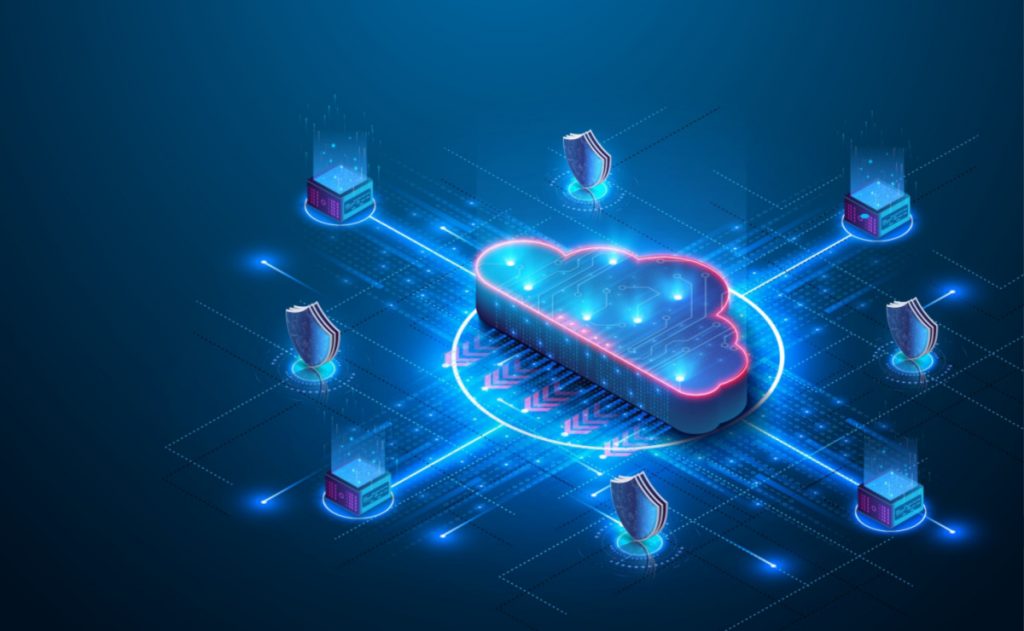

- AWS, Azure, and Google Cloud accounted for 63% of the USD 62.3 billion spent in the second quarter of 2022.

- AWS and Microsoft intend to expand their data center infrastructure over the next year to meet the demand for their services

Customer demand for cloud infrastructure services is growing rapidly, with global market data from Canalys disclosing a 33% year-on-year jump in spending on cloud infrastructure services to USD 62.3 billion in Q2 2022.

According to the market analyst firm, various factors sustain cloud infrastructure spending, including demand for data analytics, Machine Learning technologies, data center consolidation projects, and organizations aiming to shift more workloads and apps.

Canalys said in its research note, “The growing use of industry-specific cloud applications also contributed to the broader horizontal use cases seen across IT transformation.”

Cloud computing was up USD 6 billion compared to the first quarter and up USD 15 billion in the same quarter last year. Amazon Web Services (AWS), Azure, and Google Cloud accounted for 63% of the USD 62.3 billion spent in the second quarter of 2022.

AWS accounted for 31% of the overall spend on cloud infrastructure services in the second quarter; Microsoft for 24%, and Google for 8%, according to Canalys, indicative of the fact that the market was effectively a two-horse race.

“The hyperscale battle between leader AWS and challenger Microsoft Azure continues to intensify, with Azure closing the gap on its rival,” said Canalys.

“Fueling this growth, Microsoft pointed to a record number of larger multi-year deals in both the USD 100m-plus and USD 1bn-plus segments. A diverse go-to-market ecosystem, combined with a broad portfolio and wide range of software partnerships, is enabling Microsoft to stay hot on the heels of AWS.”

AWS and Microsoft intend to expand their data center infrastructure over the next year to meet the demand for their services. Amazon plans to add 24 availability zones across eight cloud regions. Microsoft plans 10 new territories in the following year.

“Cloud remains the strong growth segment in tech,” said Alex Smith, vice-president of Canalys. “While opportunities abound for providers large and small, the interesting battle remains right at the top between AWS and Microsoft. The race to invest in infrastructure to keep pace with demand will be intense and test the nerves of the companies’ CFOs [chief financial officers] as both inflation and rising interest rates create cost headwinds.”

“Cloud remains the strong growth segment in tech. While opportunities abound for providers, large and small, the interesting battle remains right at the top between AWS and Microsoft. The race to invest in infrastructure to keep pace with demand will be intense,” Smith added.

To sail the pressures, Microsoft announced plans to extend the usable life of its servers and network equipment from four to six years in its fourth-quarter financial results.

“This will improve operating income and suggests that Microsoft will sweat its assets more, which helps investment cycles as the scale of its infrastructure continues to soar,” added Smith.

“The question will be whether customers feel any negative impact in terms of user experience in the future, as some services will inevitably run on legacy equipment.”