Highlights:

- Finix provides a platform for merchants to accept customer payments without requiring programming expertise, making it accessible to businesses lacking in-house development teams.

- The company offers a checkout page that online retailers can integrate into their websites to facilitate transactions.

Recently, a startup, Finix Inc., has raised USD 75 million in funding to expand the adoption of its payment platform, which currently processes over 400 million transactions daily.

The Series C investment was co-led by Acrew Capital, Leap Global, and Lightspeed Venture Partners, with participation from over half a dozen additional investors, including Citigroup Inc.’s venture capital arm. This latest funding round raises Finix’s total external financing to over USD 200 million.

San Francisco-based Finix provides a platform that enables merchants to accept customer payments. Unlike many competing services that require programming expertise for setup, Finix’s platform is designed to be more user-friendly, making it accessible to businesses that lack in-house development teams.

“Finix offers no-code payment solutions for the 22 million businesses without developers, enabling seamless payment integrations with little to no technical expertise. Even businesses that have developers don’t want to spend their time or resources on payments,” said Richie Serna, Co-founder and Chief Executive Officer.

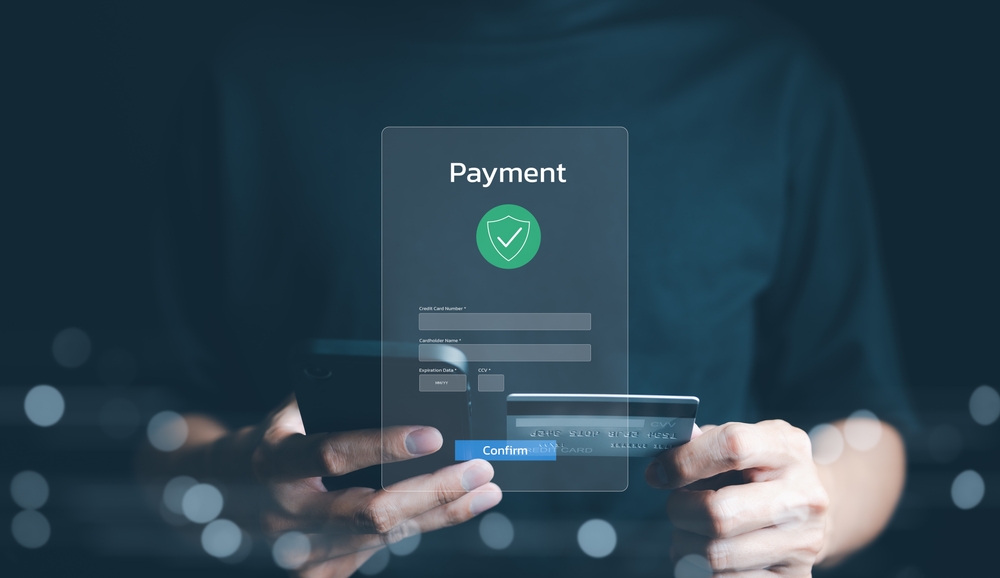

Finix offers a checkout page that online retailers can embed into their websites to facilitate transactions. A no-code configuration tool allows businesses to personalize the page with their logo and branding. Customers can pay using a variety of methods, including credit cards, bank transfers, and digital wallets like Apple Pay.

For merchants who don’t have a website, Finix provides the option to generate payment links. These links guide customers to a standalone checkout page, pre-configured with the purchase details.

Finix also aims to simplify in-store purchase processing. Retailers who sign up for the platform gain access to payment terminals for their physical locations. These devices can be managed through a cloud-based dashboard, providing a centralized interface for easy control.

Finix claims that its platform simplifies various tasks related to processing customer purchases. One feature streamlines the review of transaction cancellation requests, while another allows merchants to implement tokenization, a cybersecurity method that safeguards sensitive financial information, like customers’ credit card numbers, from hackers.

In addition to its core tools for merchants, Finix provides features tailored for e-commerce marketplace operators. These features simplify tasks like allowing third-party sellers to list their products on the marketplace. The platform can handle user purchases, distribute proceeds to sellers, and apply platform fees.

The company revealed during a recent funding announcement that its revenue has quadrupled in the past year. To sustain this growth, Finix plans to hire additional staff and expand into new markets.